A new IMF report forecasts that the “Age of America” will end as the U.S. economy is overtaken by China, with the takeover point being sometime in the year 2016. Economists as Investors Business Daily challenge this prediction. They say the IMF calculations are wrong because they use overall GDP, not per-capita GDP. Naturally, a nation of 1.3 billion, 20% of all people on earth, is going to become a big economy. And probably the biggest.

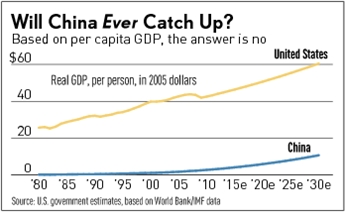

But real wealth and productivity are measured on a per-person basis. And based on that, China won’t catch the U.S. anytime and maybe never. China is way behind the U.S. in per-person income. Per-capita GDP in the U.S. is $42,517 in 2005 dollars. In China, it’s about $2,802. As the chart below shows, even by 2030, China doesn’t get close to U.S. per-person output, not even at current growth rates.

China has at most a few more years of rapid, productivity-driven growth as it transfers millions of people from rural poverty into its cities, where they instantly see their productivity increase by a factor of as much as 10. But thanks to the one child policy, they’re growing old. By 2040, its elderly population will exceed the total population of Germany, France, Britain, Italy and Japan today. Its not going to be easy for China to maintain its current growth rate. Perhaps even impossible. The blue line below might well be headed downward on an extended graph that accounts for China’s looming social problems.

5 responses to “IMF Claim Of China Overtaking USA As Greatest Global Economy Challenged”

Complete hogwash… China’s economic model is the same one Korea used and the same one Japan used… Their economy will top out at 2/3 the size of the USA’s and then they are faced with a tough choice; reform as Korea did or stagnate as Japan has..?

Will the population not demand more reforms if they moved down that track – including political and social ones and if they don’t reform don’t they risk a revolution..?

LikeLike

*Hogwash from the IMF RB, not you…

LikeLike

Agree with Pinky there, IMF nonsense, but the IBD gt it wrong also. Additionally, a few comments: First, there is no single agreed upon and accurate determinant for GDP. While the theoretical concept is nice, there is no way to actually measure GDP accurately, let alone compare it between structurally different economies. It is a vague criterion at best.

Secondly, GDP per capita is almost meaningless, as it takes a vague concept and divides it over non-comparable population distributions. If there are extreme income disparities, GDP/cap means nothing to compare relative wealth. Thirdly, many GDP indicators are based on the Keynesian idea that consumption roughly equals production and they therefore largely ignore the influence of the state and borrowing by households and the state. The figure used is therefore not based on actual productivity at all, and a country that vastly over consumes (like the US) can therefore not be compared at all with a country that significantly over produces (like China).

The relevant comparison should not be using GDP or GDP/cap, but actual production in physical units of some sort (i.e. at industry levels), balances of trading, relative financial positions (i.e. holdings of mutual assets), commodity holdings, relative education levels, and so on. Only a broad comparison over a range of such measures will have anything relevant to say. Then one also must look at innovative capacity and the interaction between economic and political forces, as Pinko alludes to, albeit that I disagree with him.

I am prepared to give the Chinese as a people more credit for their smarts that he does. Yes there is an awful regime, yes they are corrupt as anything with a disgusting political elite that keeps itself in power by horrible oppression. On the other hand, the Chinese people have learned some significant lessons over the past and have now got a taste for economic freedom. The taste for political freedom will follow. While the Chinese government holds strong military/police power over its population, it hasn’t got total and utter control over their economic and social wellbeing, as is the case in the West. In the end it may well be that the Chinese population are much less sheep than we are. I think the Chinese government knows that and this is why they are so thoroughly oppressive and restrictive.

LikeLike

So what happens when the US and Europe go tits over. China needs the west just as much the west needs China. If countries begin to fall because they have blown the budget then no country will be strong enough to stand alone and this would include China. If their GDP per capita is only about $3000 a year it won’t take long for the cash to dry up.

LikeLike

You may be wrong there Bob. China’s problem wont’t be cash, it will be commodities, especially oil, various ores and agricultural produce. This is precisely why they are cottoning up to countries like Venezuela, India and Brazil, and why they are buying up mining operations and agricultural land all over the world. It is not for nothing the Chinese recently closed a currency exchange deal with Russia, and they are buying gold and silver like there’s no tomorrow. The time may rapidly come that nobody gives a whisker about a strongly devalued USD, while the Euro may well collapse with strong European (the Northern) economies reverting to their original currencies. Remember that many western economies are highly dependent on cheap Chinese imports. If US and Europe go tits up, the markets for the Chinese will be the sub-continent, South America the Pacific and (upcoming) Africa.

The actual GDP/capita is irrelevant in absolute terms it all revolves around trade balances.

LikeLike