I was going to hold off on commenting on the TPP until I had seen some parliamentary debate but I’m not sure when that’s going to happen so decided to plunge in.

I was going to hold off on commenting on the TPP until I had seen some parliamentary debate but I’m not sure when that’s going to happen so decided to plunge in.

As with a number of other such agreements it could be some time before the TPP becomes a reality. Once a free trade agreement has been concluded, it needs to be legally verified, signed and then ratified by the governments of the parties involved. Changes to legislation may also be needed. For these reasons it takes time from when the negotiations are concluded, to when the agreement comes into force.

Will it ever come into force? Who knows, but my hypothesis is whether it does or does not is of no real import either way.

NZ is actually awash in so called Free Trade Agreements.

Here (via Wiki) is a list of Free Trade Agreements of which New Zealand is part and the date of coming into force.

Australia: Closer Economic Relations (1983)

Australia: Closer Economic Relations (1983) China: New Zealand–China Free Trade Agreement (2008)

China: New Zealand–China Free Trade Agreement (2008) Thailand: New Zealand and Thailand Closer Economic Partnership (2005)

Thailand: New Zealand and Thailand Closer Economic Partnership (2005) Singapore: New Zealand and Singapore Closer Economic Partnership (2001)

Singapore: New Zealand and Singapore Closer Economic Partnership (2001) Brunei: Trans-Pacific Strategic Economic Partnership (2005)

Brunei: Trans-Pacific Strategic Economic Partnership (2005) Chile: Trans-Pacific Strategic Economic Partnership (2005)

Chile: Trans-Pacific Strategic Economic Partnership (2005) Singapore: Trans-Pacific Strategic Economic Partnership (2005) – Auxiliary to New Zealand and Singapore Closer Economic Partnership

Singapore: Trans-Pacific Strategic Economic Partnership (2005) – Auxiliary to New Zealand and Singapore Closer Economic Partnership- Association of Southeast Asian Nations: – negotiating along with Australia since (2004)

Malaysia: Malaysia–New Zealand Free Trade Agreement announced on 2 June 2009

Malaysia: Malaysia–New Zealand Free Trade Agreement announced on 2 June 2009 Hong Kong: New Zealand–Hong Kong, China Closer Economic Partnership (2011)

Hong Kong: New Zealand–Hong Kong, China Closer Economic Partnership (2011)

Here is a list of pending FTAs, TPP excluded.

Mercosur: New Zealand-Mercosur Free Trade Agreement – negotiating since 2010

Mercosur: New Zealand-Mercosur Free Trade Agreement – negotiating since 2010- The Trans-Pacific Strategic Economic Partnership, a multilateral trade agreement involving 4 countries with which New Zealand has existing trade agreements – Malaysia, Brunei, Chile, Singapore, and Australia – and nations with which New Zealand does not have an existing FTA:

United States: New Zealand–United States Free Trade Agreement

United States: New Zealand–United States Free Trade Agreement Peru: Negotiating alongside the United States, Australia and Vietnam to join the Trans-Pacific Strategic Economic Partnership

Peru: Negotiating alongside the United States, Australia and Vietnam to join the Trans-Pacific Strategic Economic Partnership Vietnam: Negotiating alongside the United States, Australia and Peru to join the Trans-Pacific Strategic Economic Partnership

Vietnam: Negotiating alongside the United States, Australia and Peru to join the Trans-Pacific Strategic Economic Partnership

Japan: Conducting feasibility study as of (14 May 2008)

Japan: Conducting feasibility study as of (14 May 2008) Gulf Cooperation Council: (2006/07)

Gulf Cooperation Council: (2006/07) India India–New Zealand Free Trade Agreement – negotiating since 2007 with the establishment of a JSG (Joint Study Group) looking at the feasibility of an Indian-NZ FTA

India India–New Zealand Free Trade Agreement – negotiating since 2007 with the establishment of a JSG (Joint Study Group) looking at the feasibility of an Indian-NZ FTA Russia Russia-Kazakhstan-Belarus Free Trade Agreement – negotiating since 2010

Russia Russia-Kazakhstan-Belarus Free Trade Agreement – negotiating since 2010 Kazakhstan Russia-Kazakhstan-Belarus New Zealand Free Trade Agreement – negotiating since 2010

Kazakhstan Russia-Kazakhstan-Belarus New Zealand Free Trade Agreement – negotiating since 2010 Belarus Russia-Kazakhstan-Belarus Free Trade Agreement – negotiating since 2010

Belarus Russia-Kazakhstan-Belarus Free Trade Agreement – negotiating since 2010

So, with all of these agreements either existing or in the pipeline, we apparently still need another? What message does this send to any thinking person? What in NZ’s present or past economic position stands as a real testament to the benefit of these agreements beginning as far back as 1983?

Here we are in 2016 teetering on the edge of an economic abyss and saved from falling in the govt’s own admission by massive immigration and tourism. What then have all those previous FTAs delivered? (And when you think about the answer to that question, remember the SERVICE industry is 70% of the NZ economy. IOW, 70% of the economy does not produce any goods. )

English and Key don’t like to talk about GDP per capita, for with 60,000 or 70,000 new citizens every year its not a good look. The real national disposable income per capita fell 0.4 percent for the year. The truth is the NZ economy is not the world beating example of economic management the National Party tells you it is. It limps along on sectors that are not part of any FTA.

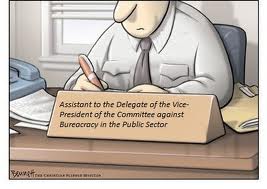

Of course as with anything coming from govt, we can expect the opposite of whatever things are named. For example the Ministry of Business Innovation and Employment actually works to hobble those areas in the NZ economy. With a massive budget ($4.3 billion) and staffed by a legion (3000) of over paid shiny arsed paper shufflers they’d actually do the economy so much better by leaving their regulation producing jobs, relieving the taxpayer of the burden of their wages, and picking fruit.

So as the MBIE is a job destroying innovation crippling farce, so we have Free Trade agreements that are not really free trade.

How can the TPP for example, covering 12 Pacific nations and encompassed in a 5544 page document of regulations and side issues, be in any way representative of free trade? Incursions into our own sovereignty and draconian illiberal laws relating to copyright enforcement are only the tip of the iceberg.

What is more, as I stated above it is subject to ratification by each member’s govt, but if this has not happened before February 2018, it will be imposed on non-signatories by means of a clause that says it will enter into force after ratification by at least 6 states, which hold together a GDP of more than 85% of the GDP of all signatories.

Does this sound like Free Trade to you?

Here is another question for you. China is one of the worlds biggest exporters. Why hasn’t it therefore joined the TPP? I’ll tell you. Its doing quite OK without it.

World Bank estimates say the agreement will benefit NZ by only 3% by 2030. I say this prediction in these volatile times is not worth the paper it was written on. Its a figure that probably isn’t even close to being outside the margin of error. The same organisation puts the estimated benefit to Australia at only 0.7%

Minimum wage legislation is perhaps the most stark example of the futility of so called “Free Trade” agreements. How can one country with such legislation trade freely with another country that does not have a minimum wage? Does “minimum wage” mean something or is it just window dressing? If it means something, why then enter into international trade agreements that work to undermine it? This is just one of many such conflicts that prove the whole thing is just so much feel good socialist nonsense.

The Australian Productivity Commission makes the point that the TPP is not free trade but “preferential trade”. It also says-

- PTAs actually add to the red tape burden and compliance costs on Australian and foreign businesses because of the Byzantine country-of-origin rules applying to products that can benefit from the agreements (there’s a comically absurd list of “Rules of origin for Bed linen, table linen, toilet linen and kitchen linen” in Australia’s PTAs);

- Similarly, there are complex and wildly varying rules for determining whether a company is sufficiently a company of one of the signatory countries to take advantage when it comes to services;

- The benefits to Australian companies often don’t materialise because non-border or other economic barriers remain in place, especially in services;

- The secrecy around the negotiation and assessment of PTAs is damaging, and “transparency is paramount”; and

- The Commission is unable to form a view as to whether the aspirational goals are commensurate with potential real-world impacts.

The TPP is just another big govt fraud that is, just like all the other so called FTAs before it, unlikely to bring any real benefit to NZ that did not exist anyway.

The way to true Free Trade is through deregulation by govts, not by means of 5544 pages of legal gobbledygook. In fact its ridiculous to ever expect free trade to be a reality when govts are so huge and so powerful. How can an over-regulated economy like Australia or NZ ever trade profitably with small govt low regulation countries? The Singapore govt costs its traders about $40 billion to run. NZ traders pay $100 billion. How can we possibly compete?

Here’s another important comparison-

New Zealand

total dependency ratio: 54%

youth dependency ratio: 31.1%

elderly dependency ratio: 22.9%

Govt taxes and other revenues 43.1% of GDPSingapore

total dependency ratio: 37.4%

youth dependency ratio: 21.4%

elderly dependency ratio: 16.1%

Govt taxes and other revenues 15% of GDP

Govts following Keynesian economic policies and determined to remain popular with voters borrow without limit, print their own money, manipulate exchange and interest rates, and heavily regulate business. While this goes on how can the long awaited “level playing field” ever arise? Answer it can’t. So therefore under big govt socialism, “free trade” especially without any kind of leveling mechanism, is just as mythical as the damn unicorn.

FTAs and the TPP are just more of the same old socialist smoke and mirrors when things that really would make a difference ARE LEFT UNTOUCHED.

Note- So what do you want I might hear you ask? I want this.

7 responses to “The TPP, yet another political class con job on voters”

The UK just cut its corporate tax rate by over 10%, heading towards zero.

No-one in NZ has explained what this means for NZ – that we need to do the same, immediately, zero our corporate tax rate just to remain competitive!

Singapore is working hard to reduce it’s dependency ratio, they want their govt to be down to 5% of the economy by 2025. NZ’s government has got bigger every year since Ruth Richardson was fired by Blodger…

LikeLike

Red, you can’t have true free trade without a metallic standard. Under a metallic standard if the US has a $500 billion trade deficit, they will continue to have less and less money. Less and less money, means prices and wages go down. Once that adjustment has happened, they can then export more, as things become cheaper to produce. With a metallic standard any trade deficit is only temporary.

What we have here is if the Chinese lend them that $500 billion per year, the adjustment will never take place. What we call free trade is not true free trade. And this TPP means banks will have even more control and power to continue to do this.

David Ricardo’s comparative advantage argument was all about each person doing what they do best and then trading. He would be shocked, if he found out his name was being used to advocate one nation borrowing money, to fund imports all in the name of free trade.

LikeLike

How my argument has to do with a metallic standard, is when China lends $500 billion, it can only be used to buy Chinese goods. Whereas if gold were used to lend to the US, the US can use that money to buy from anybody. In essence Chinese loans can be used to keep exporting more than they import. But if gold is used, it won’t necessarily be used on Chinese imports.

LikeLike

is when China lends $500 billion, it can only be used to buy Chinese goods.

wrongo, idiot. China “lends” the US US dollars which the US can use to by whatever-the-fuck it likes.

And guess what: if the US doesn’t may China back, it is China that is out-of-pocket – not the US. Which is what will happen, the US will simply inflate its way out of the debt, or just refuse to pay (e.g. by starting a war in the South China Sea, or requiring China to “drop the debt” to enter into another “Free Trade Agreement”)

LikeLike

Angry Tory, all money is created by a central bank. The central bank of China creates Chinese currency. When they import US goods, they pay for it with Chinese currency. When the US buys Chinese goods, they pay for it with US dollars. The exchange rate is where the US’s currency buys Chinese currency, and China buys US currency. So, yes they buy US treasuries, but the consideration is from Chinese currency.

Maybe you’re not aware of it, but the Federal Reserve is a bank. They lend to banks, and they lend to the US government. So the statement that they can print money, is assuming that the Federal Reserve is a government owned bank. Even in the link, where they try to say its government owned, they admit that a dividend to bankers must be paid first. So that tells you it is not totally government owned.

https://www.google.co.nz/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwik1szImuPLAhWJW5QKHZ6qCckQFggaMAA&url=https%3A%2F%2Fen.wikipedia.org%2Fwiki%2FFederal_Reserve_System&usg=AFQjCNHrbjYlDVsr-a9k-BxQCGvbc2XY6Q&sig2=gqpya8PmS_-UHH4PtDaOjA

And then their is NZ. The Reserve bank is government owned according to their website. Until you take a look at this link:

https://www.google.co.nz/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwiPh8zom-PLAhUDmpQKHTgIAZIQFggaMAA&url=http%3A%2F%2Fwww.legislation.govt.nz%2Fact%2Fpublic%2F1961%2F0003%2Flatest%2Fcontents.html&usg=AFQjCNEs8OSgTXMbTR8RvNWlFwYVjXQ5pQ&sig2=qJtq4RSS9B_FaL4fDXqIyw

What this tells you in sections 4 to 6, is that the Reserve bank is responsible to pay back those that lent to us. So the Reserve bank collects from the treasury, from income tax, fines, user fees etc, and uses that to repay the bondholders, who lend the government money. So the textbooks seem to suggest that the government creates money out of thin air, and that’s it. When in reality, that money needs to be repaid.

Let’s put it another way. The US owes about $19 Trillion. What is there money supply? If their money supply is also $19 Trillion then it can all be repaid. But if its less than $19 Trillion this means their money supply is lent into circulation with an interest charge.

https://www.google.co.nz/url?sa=t&rct=j&q=&esrc=s&source=web&cd=4&cad=rja&uact=8&ved=0ahUKEwjZ8-7-nOPLAhWDNJQKHUR2BBMQFggvMAM&url=http%3A%2F%2Fwww.usdebtclock.org%2F&usg=AFQjCNGiB_Hpta4GHtGKiVVUTRoaQmz8aQ&sig2=c57HJ4YfA81U9GIFqqAI9w

M1 means money in circulation. M2 means M1 plus savings. Both are well below $19 Trillion. The textbooks don’t teach certain things, cause otherwise people would want to change the system.

Going back to my point, we have a floating exchange rate. The demand for our currency must equal our supply for our currency. Anytime this isn’t the case the exchange rate must be adjusted to allow for any shortfall. If the exchange rate is 65 cents, and we have a shortfall, and our reserves are being depleted we must adjust it, and reverse the shortfall. This is all spelled out with the IMF, that countries have reserves on hand, but only a limited amount.

So what this means is every time $500 billion gets lent to the US, they must adjust their currency, so that the inflow of currency equals the outflow of currency. If their was no lending, investing or buying of businesses between nations, the exchange rate would be set where imports of goods equals exports of goods. But the fact of the matter is the equilibrium of the exchange rate is where all inflows equals outflows. This means overseas investments, loans and buying and selling of businesses all affect the outflows and inflows.

LikeLike

Or how bout this. This is what my Barron’s law dictionary says. A law dictonary is legally binding in a court of law:

Money: coined metal, usually gold or silver, upon which a government has impressed its stamp to designate its value. While money was once limited to “coin of the realm,” in common usage the term refers to any currency, tokens, bank notes or the like accepted as a medium of exchange. Under the Uniform Commercial Code, money is defined as “a medium of exchange” authorized or adopted by a domestic or foreign government as a part of its currency.” U.C.C. 1-201(24)

And according to this link money is defined as: (24) “Money” means a medium of exchange currently authorized or adopted by a domestic or foreign government. The term includes a monetary unit of account established by an intergovernmental organization or by agreement between two or more countries.

https://www.google.co.nz/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwjJ0syer-PLAhXGGZQKHdPHB6QQFggaMAA&url=https%3A%2F%2Fwww.law.cornell.edu%2Fucc%2F1%2F1-201&usg=AFQjCNFKQAn3HN8vIKYluvBTGJnMyHyH8Q&sig2=eGlmlS3A0xzMQ-axBCkbTA

So, things are not as simple as you think, notice the term intergovernmental organization. For people to be involved in trade, their has to be some sort of agreement/treaties between nations. And if one nation is going to mess around, the others just might gang up on them.

LikeLike

You have hit the nail on the head again Red.

There is no such thing as a FREE trade agreement, especially when our main exports are always exempt from the agreement.

There are many different types of trade barriers.

Every now and then (every few years) we import a container from Asia. It costs more to get it off the ship, onto a truck and into a secure yard,than it does to load it, put it on a truck, send it to a port, load it onto a ship and ship it to New Zealand.

With the Government requiring 45% of the Countries GDP to run the Country, that means half of all sales have to go to the Government, we will never be Internationally competitive.

The main point is that we are not Internationally competitive.

The Government TAX tack has crippled the Country and it is only going to get worse as people rebel and opt out of any type of work endeavor.

LikeLike